Managing Risk, a Task That is Key to Profitability.

CALL TO ACTION

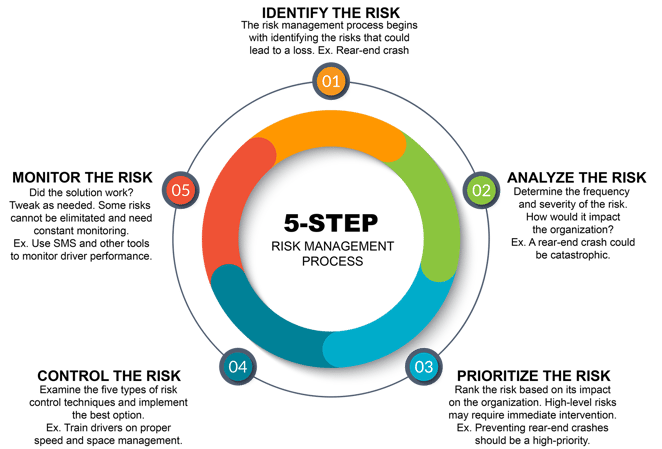

- Train managers and supervisors on the risk management process.

- Assign personnel to identify risks affecting their departments.

- Rank each risk and prioritize those needing immediate intervention.

- Evaluate alternative risk management techniques such as engineering controls.

Check out my website at https://www.shawnnhelpingtruckers.com

For factoring/fuel cards check out https://www.rtsinc.com/agent-company/

As always, you can count on the commercial truck insurance professionals at The Daniel & Henry Company to assist you through challenging claims and all of our insurance, risk management, and safety issues. Contact us today to discuss solutions for your transportation risk management program.